Are you looking for the best digital marketing website, and then your search ends here. You will gain in-depth knowledge about Venmo app and “how to add money to Venmo app” quickly.

Table of Contents

What is Venmo?

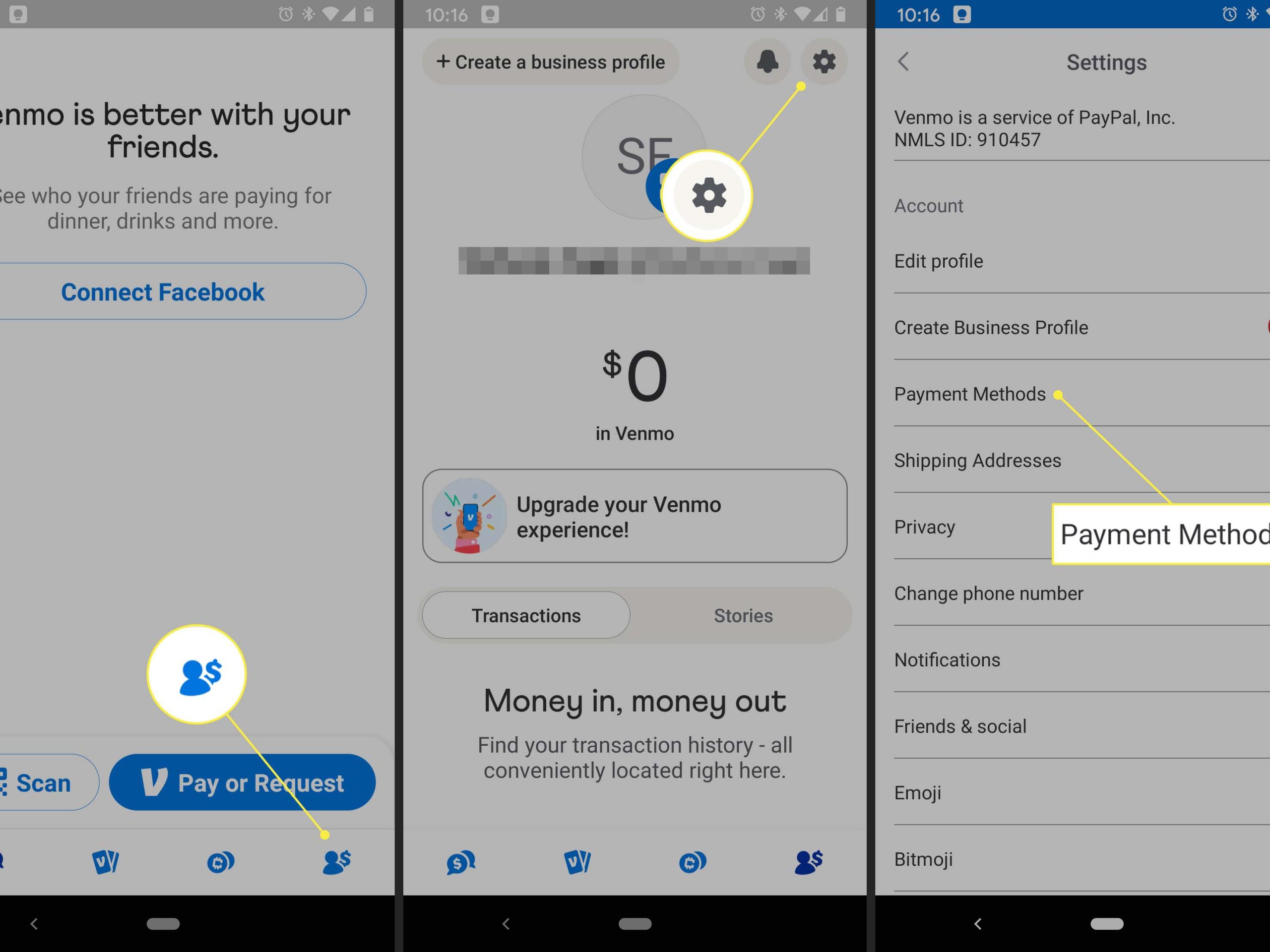

Credit: Lifewire

Venmo is most widely used for a payment transfer app that lets them quickly and easily exchange money directly between two.

However, if you want to send cash back for something and your Venmo balance is insufficient, the app will remove the entire amount from your linked bank account or card, which can be inconvenient.

If you like to avoid this, you can manually add money to the app from your linked bank account if you have been approve for a Venmo Card.

You can still add a payment to your account if you haven’t been approved for, or don’t want, a Venmo Card.

How to Add Money to Venmo?

One of the best things about Venmo app is that you never have to worry about running out of money because your account is linked to your bank account. Even if your Venmo account balance is zero, you can still make a payment. If you submit a payment amount that exceeds your Venmo account, Venmo will deduct the difference from your associated funding source. (However, if you don’t have the money in your bank account, that’s another situation.)

Adding Money to your Venmo Account

After you’ve created a Venmo account, you’ll need to create funding sources to add money to it so that you can send it to different people later. This can be done using a debit card, credit card, or bank account.,

You can also fund your Venmo account by receiving money from other Venmo users.

Venmo payments can be funded from your bank account

Venmo allows you to add a bank account as a financing source to your profile. This implies that you can make a payment using funds directly from your bank account.

You must follow the procedures below to link your bank account:

- Select the menu option

- Go to Settings and then Payment Methods

- Select Bank from the Add bank or card menu

- After that, you must select your verification method

Before you can use Venmo for transfers, you must first verify your account, which you can do in one of two ways: manually or instantly.

Venmo payments can be made with a credit or debit card

You may use your credit or debit card to make payments using Venmo, but like many other ,online services, you must first set it up by supplying some basic card information.

To complete this task, you will need to:

- Select the menu option (the one with three horizontal lines)

- Go back to settings and then click to payment Methods.

- Select Add a bank or credit card and select the Card option.

- Choose whether to manually enter your card details or use your phone’s camera.

It’s a good idea to have contact information for the card issuer’s customer service representatives. This is because your card may be denied during verification if your zip code has changed recently.

Is Venmo a secure payment platform?

Is it safe to use Venmo? Yes. Venmo protects your funds and account information using encryption. Multi-factor authentication is also used to validate your identity and add an extra layer of protection. In fact, you may create a unique PIN in the app to ensure that you only use your Venmo application account to send and receive money. Additional security protections, like as Touch ID login options, are available in the Venmo app.

However, Venmo scams do occur, and you should be aware of them to avoid them. Many Venmo scams start on Craigslist and Facebook Marketplace, where untrustworthy Venmo users can con both buyers and sellers. Only send money to people and retailers you know and trust on Venmo to avoid being scammed.

Credit: Time

Adding Money to Venmo using Your Bank Account

Linking your personal bank account to your Venmo account is the first option for funding your purchases. While Venmo will default to utilising your app balance first, you can add your bank account as a transfer option if your balance is insufficient to cover your purchase.

Here are few step to add money to Venmo

- From the bottom menu, select the Profile icon.

- Then select Payment Methods from the drop-down menu.

- Tap Add a bank account or credit card.

- Tap Bank.

- Select a method of verification.

If you enter your bank’s login credentials, you may be able to authenticate instantaneously; otherwise, Venmo sends $2 micro-transfers to your account to validate your identity. Because micro-transfers take a business day to process, you won’t be able to pay anyone right away.

Another advantage of using your bank account to add funds is that it’s a two-way street; you can also move your Venmo balance to your bank account. So, instead than having your roommate pay their share of the rent via Venmo, you may have it sent to your bank account.

Credit: Lifewire

Add Money to Venmo’s App Account Balance

Only by transferring money from a linked bank account can you add money straight to your Venmo’s count at a few times. This option is available only if you have applied for and received a Venmo’s debit card.

Direct Deposit using Venmo

Another way to add money to your Venmo’s bank account is to have your wages deposited openly into your account. Follow the steps below to set up through deposit:

- Firstly, open the Venmo’s application

- Choose the You tab

- Select direct deposit button from the setting menu

- Select Account Number to Display

- Get note of the bank account number and account details displayed.

- Then, fill out your employer’s form with these details.

Additionally, if you asked for your bank’s name or residence address while filling out the blank form, one’s can acquire the information from Venmo’s customer care official page at “help.venmo.com”.

Furthermore, employer to initiate transferring financial funds into your Venmo bank account once you have completed the direct deposit information. Changes in direct deposit information may take up to two pay cycles to take effect.

Your paychecks will start accumulating to your Venmo balance once you’ve set up direct deposit.

Additional Options to Fund Venmo’s Accounts

Whenever, If none of the above alternatives work for you, here are a few other options for funding your Venmo’s bank account:

- Ask with a friend: Organize to give someone amount in exchange for them sending you money via Venmo. This cash will appear in your Venmo’s bank balance Right now. Use this strategy only with persons you absolutely trust. It is incredibly simple to be duped in this manner.

- Reloading your Venmo debit card: The reload attribute enables you to expend more than your Venmo’s bank balance by withdrawing the difference from a linked bank account.

- Cash a check service: If you have a Venmo’s debit card and have set up direct deposit, you can use this service.

To money a check using Venmo, follow these steps:

- Choose the You tab

- Select Manage Balance

- Choose Cash a Check

- After entering the amount, take pictures of both the face and back of the bank check

- Select how to wish to get your payments (quicker money more in fees)

- While the demand is being process, please wait. It may take up to 1.5 hours, although it is usually only a few minutes

- You will be asked to mark VOID on your check if your request is approve. Do not do this except you are specifically asked to.

- You’ll be prompt to photograph the voided check.

- A abstract page will appear, including the detail of your check cashing.

- Depending on whatever option you choose, the finances will be within 10 days a few minutes.

You do not require to contribute money to your Venmo’s bank balance to use Venmo for most reasons. Even if your Venmo balance is low, you can deliver money and pay using Venmo utilising associated payment options.

Then, look at the bottom of the computer screen where you enter payment information to see what payment method you’re currently using.

Holding money in another currency?

Venmo is a good option for making payments within the US, and however, if you like to hold and pay your money internationally, the platform won’t support it.

Frequently Asked Questions (FAQs)

Q-1 What is a Venmo balance?

Ans: The money in your Venmo account that you received from friends, relatives, and others is your Venmo balance.

Q-2 How does Venmo work?

Ans: Venmo allows you to link your bank account and transfer money back and forth, ensuring that your money is where you want it when you want it.

Q-3 Is there a price for using Venmo?

Ans: There are no fees when money from your Venmo account is forwarded to another Venmo account or when money is received from a friend’s Venmo balance into your Venmo account.

Q-4 What is the difference between Venmo and other cash app?

Ans: Venmo and cash app both have a variety of features, some of which overlap and others of which distinguish them.

Conclusion

There are various ways to fund your Venmo account. You can send money easily from your bank account number or have your paycheck deposited into your Venmo’s bank account. However, you do not require a Venmo balance to use the app; you can send money through Venmo using a linked payment method. A bank transfer of funds takes 3 to 5 trade days to appear in your Venmo’s balance. When transferring or paying with associated payment methods, there is no delay.

Additionally, Read our popular article “Do Money Affirmations work?”.